Introduction

The global financial architecture has undergone a dramatic transformation over the last two decades, driven primarily by technological innovation and digital payment ecosystems. China, in particular, has emerged as a dominant force in redefining transaction behaviour, with two major players — UnionPay and Alipay — shaping how consumers and businesses interact with money. Although both platforms facilitate payments, their nature, structure, and operational logic differ fundamentally.

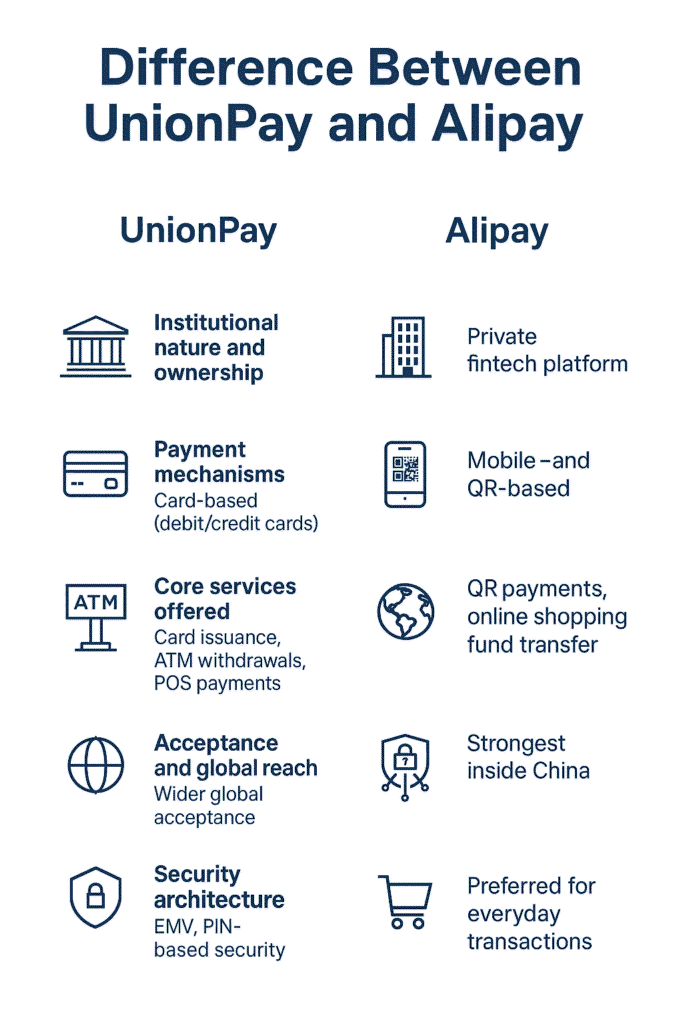

1. Institutional Nature and Ownership

UnionPay

UnionPay, officially known as China UnionPay, is a state-owned financial services corporation founded in 2002. It operates under the approval of the People’s Bank of China (PBoC). Its core function is similar to Visa or MasterCard — it is a bank card association that provides the backbone for card-based transactions.

Alipay

Alipay, launched in 2004 by Alibaba Group (now operated by Ant Group), is a private fintech digital wallet and online payment platform. Unlike UnionPay, Alipay does not issue cards; instead, it offers mobile payments, escrow services, online transfers, and lifestyle services integrated into a single digital ecosystem.

Difference:

UnionPay is a state-regulated card network, whereas Alipay is a privately-owned digital wallet and fintech platform.

2. Payment Mechanism

How UnionPay Works

UnionPay functions through physical debit/credit cards, POS machines, and ATM withdrawals. Its operational method is traditional:

-

User → Card → POS/ATM → Bank → Settlement.

How Alipay Works

Alipay works through mobile payment apps, QR codes, and e-wallet balances, often without involving a physical card. Its workflow is digital:

-

User → Mobile App → QR Code → Alipay Account Balance/Bank → Merchant.

Difference:

UnionPay is card-based, while Alipay is mobile- and QR-based, dominating China’s “cashless” transformation.

3. Core Services Offered

UnionPay

-

Debit and credit card issuance (via partner banks)

-

ATM cash withdrawal

-

POS payments

-

Cross-border card transactions

-

Online card payments

Alipay

-

QR-code mobile payments

-

Online shopping payments (Alibaba ecosystem)

-

Utility bill payments, recharge, ticketing

-

International remittances

-

Escrow services (especially for online marketplaces)

-

Wealth management and micro-loans

Difference:

UnionPay focuses on transaction infrastructure, whereas Alipay provides a full digital lifestyle ecosystem.

4. Acceptance and Global Reach

UnionPay

UnionPay is accepted in over 180 countries, making it the most globally expanded card network after Visa and MasterCard. Many ATMs worldwide accept UnionPay cards.

Alipay

Alipay is accepted mainly in:

-

China

-

Tourist hotspots around the world

-

Online stores integrated with Alipay

It remains less globally accepted compared to UnionPay but still dominates China’s domestic market.

Difference:

UnionPay has stronger global acceptance, whereas Alipay is strongest inside China.

5. Security Architecture

UnionPay

Bank-driven security protocols include:

-

EMV chip technology

-

Fraud monitoring

-

PIN-based verification

Alipay

Alipay uses:

-

Facial recognition

-

Device binding

-

Real-time AI fraud detection

-

Escrow services for buyer protection

Difference:

UnionPay relies on bank-level security, while Alipay uses fintech-driven, AI-powered security mechanisms.

6. Consumer Usage Trends

-

In China, UnionPay cards are typically used for bank withdrawals, salary accounts, and large transactions.

-

Alipay dominates retail shopping, online purchases, taxis, food deliveries, and daily micropayments.

Difference:

UnionPay is widely used for formal banking activities, while Alipay governs everyday digital consumption.

7. Role in China’s Financial Ecosystem

UnionPay

Represents the traditional banking sector, supporting financial sovereignty, regulatory control, and international expansion.

Alipay

Represents China’s fintech revolution, driving digital payments, entrepreneurship, and e-commerce growth.

Difference:

UnionPay is systemic and state-driven, whereas Alipay is innovative, consumer-driven, and integrated with e-commerce.

Conclusion

UnionPay and Alipay are often misunderstood as competitors, yet they occupy distinct positions in China’s financial landscape. UnionPay mirrors global card networks such as Visa and MasterCard, providing foundational banking infrastructure. Alipay, however, symbolizes the evolution of digital finance, reshaping consumer behaviour through convenience, speed, and technological integration.

FAQs

1. What is the main difference between UnionPay and Alipay?

UnionPay is a bank card network similar to Visa, while Alipay is a digital wallet and mobile payment platform.

2. Is UnionPay a credit card?

UnionPay itself is not a card; it is a network. Banks issue debit or credit cards under the UnionPay network.

3. Is Alipay considered a bank?

No. Alipay is a fintech platform, not a bank. However, it links with banks and offers financial services through Ant Group.

4. Which is more widely accepted globally: UnionPay or Alipay?

UnionPay has broader global acceptance, especially at ATMs and POS terminals.

5. Can foreigners use Alipay or UnionPay in China?

Yes. Foreigners can use both through:

-

Travel cards (UnionPay)

-

International Alipay accounts

6. Which is better for online shopping?

Alipay is superior due to its QR-based payments, escrow services, and Alibaba integration.

7. Which is more secure: UnionPay or Alipay?

Both are secure, but Alipay offers AI-driven real-time fraud detection, making it more advanced for digital payments.